Automating KYB (Know Your Business) processes has become a critical priority for financial institutions worldwide. With compliance costs exceeding $60 million annually for average banks and regulatory fines reaching $5 billion in 2021 alone, KYB automation offers a transformative solution to reduce manual workload while maintaining regulatory compliance.

But can KYB processes be truly automated without human intervention? This comprehensive guide explores the challenges, solutions, and best practices for how to automate KYB effectively.

What is KYB Automation?

KYB automation refers to the use of technology to streamline and digitize Know Your Business verification processes. This includes automated data collection, document verification, UBO identification, sanctions screening, and risk assessment without manual intervention.

Know Your Business (KYB) is a compliance requirement that verifies business entities before establishing commercial relationships. Originally introduced after the Panama Papers scandal in 2016, KYB has become mandatory for regulated organizations across the US, EU, and other jurisdictions.

Modern KYB automation platforms can process over 90% of standard verification cases in under one minute, dramatically reducing operational costs and improving customer experience.

Why Automating KYB is Essential

The financial impact of manual KYB processes is staggering. Recent regulatory actions highlight the consequences of inadequate business verification:

- One bank was fined $132 million for failing to properly verify 560,000 business customers

- Over $5 billion in AML fines were issued globally in 2021

- The average bank spends $60+ million annually on KYC/KYB procedures

Automating KYB processes can potentially reduce these costs by up to 70% while improving accuracy and compliance outcomes. Financial institutions that invest in automation technology see significant returns through:

- Reduced manual processing time

- Lower operational costs

- Improved regulatory compliance

- Enhanced customer onboarding experience

- Faster time-to-market for new products

Key Challenges in KYB Automation

1. Fragmented Data Sources

One of the primary obstacles in automating KYB is the lack of unified data sources. Companies must integrate multiple databases to obtain comprehensive business information:

- National business registers

- Private data vendors

- Beneficial ownership registries

- Court records and litigation databases

Complex ownership structures spanning multiple jurisdictions make what is KYB automation particularly challenging. The recent CJEU ruling limiting public access to beneficial ownership registers has further complicated automated verification processes.

2. Document Processing Complexity

Manual document review remains the biggest bottleneck in KYB automation. While OCR and AI-driven solutions work well for standardized documents, many business documents require human validation:

- Articles of Incorporation

- Shareholder agreements

- Proof of funds documentation

- Complex corporate structures

AI-powered document analysis technologies are advancing rapidly, but hybrid approaches combining automation with human oversight remain necessary for complex cases.

3. Customer Interaction Management

Automating KYB requires sophisticated customer communication systems to handle:

- Document collection and validation

- Real-time feedback on submission errors

- Multi-language support for global operations

- Various verification methods for different customer preferences

4. Regulatory Compliance Across Jurisdictions

Different countries have varying KYB requirements, making how to automate KYB complex for international organizations. Key considerations include:

- Threshold variations for UBO identification (10-25%)

- Different document requirements by jurisdiction

- Varying sanctions lists and screening requirements

- Local data privacy regulations

Best Practices for KYB Automation

1. Implement Risk-Based Automation

Not all business verifications require the same level of scrutiny. Successful KYB automation strategies implement risk-based approaches:

- Low-risk customers: Fully automated processing

- Medium-risk customers: Automated with exception handling

- High-risk customers: Enhanced due diligence with human oversight

Risk scoring solutions enable automated decision-making while ensuring appropriate controls for higher-risk entities.

2. Leverage Multiple Data Sources

Effective automating KYB requires orchestrating multiple data providers:

- Official company registries

- Private business intelligence vendors

- Real-time sanctions and PEP databases

- Financial crime databases

Business data and UBO discovery platforms provide access to 400+ million business profiles globally, enabling comprehensive automated verification.

3. Implement Continuous Monitoring

KYB automation shouldn't end at onboarding. Ongoing monitoring systems should automatically:

- Track ownership changes

- Monitor sanctions list updates

- Detect adverse media mentions

- Flag suspicious transaction patterns

AML screening and monitoring solutions provide real-time alerts and automated periodic reviews to maintain compliance.

4. Design Flexible Workflow Orchestration

Successful what is KYB automation implementations require flexible decision engines that can:

- Chain multiple verification steps

- Handle exception scenarios

- Escalate complex cases appropriately

- Adapt to changing regulatory requirements

The Future of KYB Automation

Emerging technologies are making automating KYB more sophisticated and effective:

Artificial Intelligence and Machine Learning

AI technologies are improving document processing accuracy and enabling:

- Advanced OCR for complex documents

- Automated risk assessment

- Predictive analytics for fraud detection

- Natural language processing for adverse media screening

Blockchain and Digital Identity

Distributed ledger technologies may revolutionize KYB automation by providing:

- Immutable audit trails

- Shared compliance databases

- Self-sovereign identity solutions

- Cross-institutional verification sharing

Regulatory Technology (RegTech)

Purpose-built RegTech solutions are making how to automate KYB more accessible for smaller institutions through:

- Cloud-based compliance platforms

- API-first architectures

- Pre-built regulatory templates

- Automated reporting capabilities

How Dotfile Enables Complete KYB Automation

Dotfile's comprehensive business verification platform helps regulated institutions achieve over 90% automation in their KYB processes through:

Automated Data Collection and Enrichment

- Streamlined web portal and API integration - Provides both user-friendly interfaces for manual data entry and robust APIs for seamless integration with existing systems, eliminating the need for multiple platforms

- Multi-provider orchestration across 200+ jurisdictions - Automatically connects to official company registries, private data vendors, and government databases worldwide, ensuring comprehensive business information regardless of where entities are incorporated

- Real-time business data enrichment - Instantly pulls and updates company information including ownership structures, financial data, and regulatory status from authoritative sources as soon as it becomes available

- Custom onboarding flows for different customer segments - Creates tailored verification journeys based on risk profiles, entity types, and jurisdictional requirements, optimizing the process for both high-risk and low-risk customers

Intelligent Checks and Validation

- Cascading identity verification workflows - Automatically sequences multiple verification methods (document checks, biometric verification, database lookups) based on initial risk assessment, ensuring thorough validation without unnecessary friction

- OCR and AI-powered document processing - Uses advanced optical character recognition and machine learning to extract and validate information from business documents, reducing manual review time by up to 80%

- Comprehensive AML screening with false positive reduction - Screens against global sanctions, PEP, and adverse media databases while using AI to minimize false matches, reducing compliance team workload

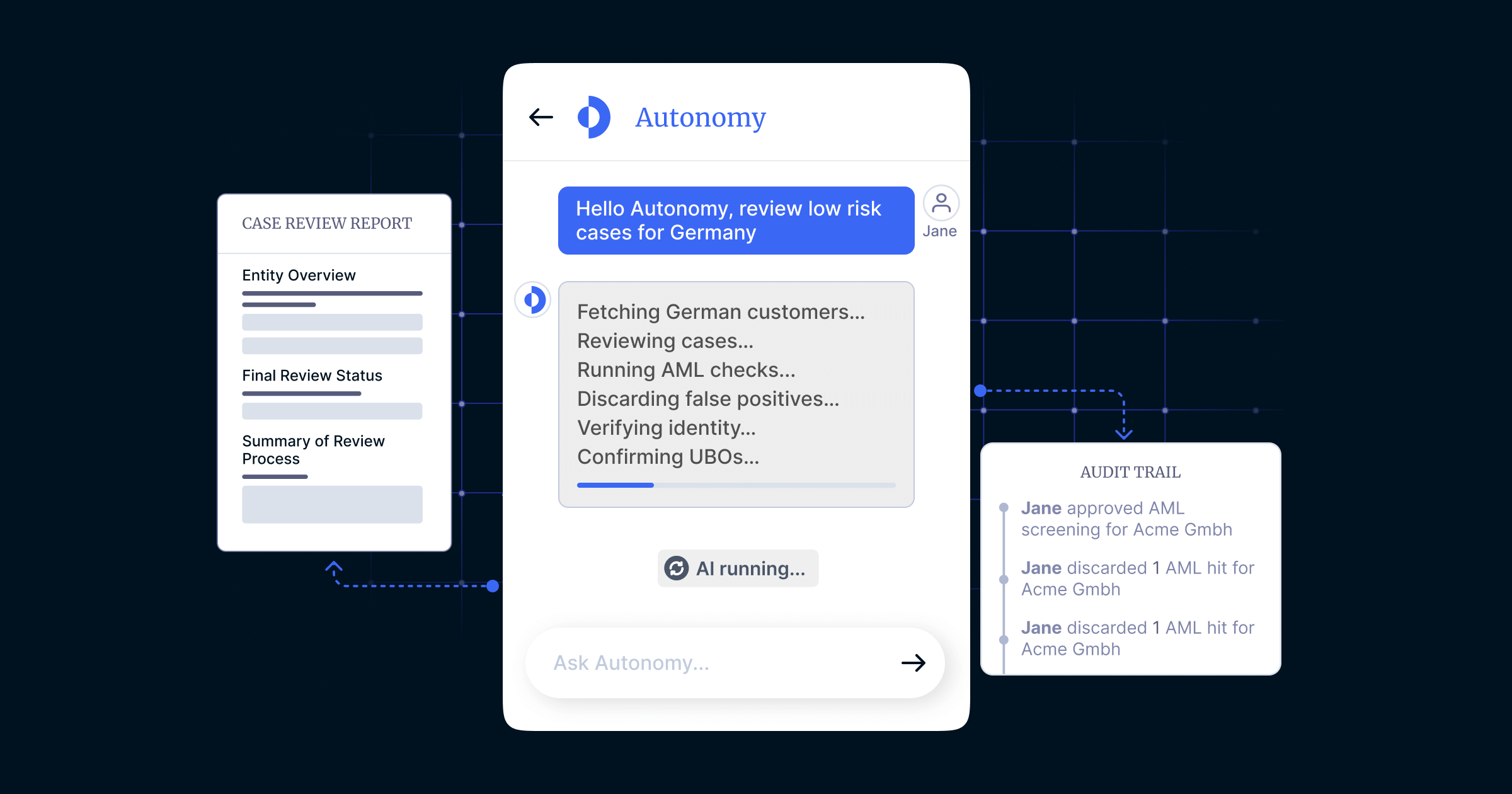

No-Code Decision Engine

- Automated decision-making based on configurable rules - Allows compliance teams to set up complex decision trees without programming knowledge, automatically approving, rejecting, or escalating cases based on predefined criteria

- Custom risk scenarios and escalation workflows - Enables creation of specific pathways for different risk situations (e.g., high-risk jurisdictions, complex ownership structures) with appropriate review levels and approval requirements

- Real-time case management and collaboration tools - Provides centralized dashboards where compliance teams can track case progress, assign tasks, and collaborate on complex investigations with full audit trails

- Audit trail and regulatory reporting - Automatically generates comprehensive documentation of all verification steps and decisions, ensuring regulatory compliance and simplifying audit processes

Continuous Monitoring and Compliance

- Ongoing monitoring for ownership changes - Automatically tracks changes in business structure, ownership, and key personnel through continuous monitoring of official registries and news sources

- Automated sanctions list updates - Receives real-time updates from global sanctions databases and automatically re-screens existing customers when new sanctions are imposed

- Adverse media monitoring - Continuously scans news sources and regulatory announcements for mentions of existing customers, alerting compliance teams to potential reputational or regulatory risks

- Periodic review automation - Systematically schedules and conducts regular reviews of customer information based on risk profiles and regulatory requirements, ensuring ongoing compliance without manual intervention

Measuring KYB Automation Success

Key performance indicators for successful automating KYB initiatives include:

- Automation Rate: Percentage of cases processed without human intervention

- Processing Time: Average time from application to approval

- False Positive Rate: Accuracy of automated screening decisions

- Customer Satisfaction: Onboarding experience metrics

- Compliance Score: Regulatory audit results and findings

Conclusion

Automating KYB is no longer a luxury but a necessity for financial institutions facing increasing regulatory pressure and operational costs. While complete automation remains challenging due to complex ownership structures and document varieties, modern platforms can achieve 90%+ automation rates for standard verification cases.

Success in KYB automation requires a strategic approach combining multiple data sources, AI-powered document processing, risk-based decision-making, and continuous monitoring. Organizations that invest in comprehensive automation platforms like Dotfile can significantly reduce compliance costs while improving customer experience and regulatory outcomes.

Book a demo to discover how Dotfile can help you achieve complete KYB automation and transform your compliance operations.